Can a Seller Refuse to Pay Closing Costs?

Can a seller refuse to pay closing costs? In short, the answer is yes. There are certain circumstances in which the seller is not obligated to contribute to the buyer’s closing costs, and can instead choose to pocket that money. However, there are also times when the seller may be expected to help out with these expenses.

It’s important to remember that each real estate transaction is unique, so it’s always best to consult with an experienced real estate agent or lawyer before making any final decisions.

What Are Buyer-Paid Closing Costs?

Closing costs are fees associated with the purchase and sale of a home. These fees – usually amounting to 2%-5% of the home’s sale price – can be paid by either the buyer or the seller, but most often it is the buyer who is responsible for them.

Some common closing costs include:

- Appraisal fee

- Credit report fee

- Home inspection fee

- Loan origination fee

- Mortgage insurance premium

- Property taxes

- Title insurance

- Survey fee

While these are just some of the most common closing costs, there could be others depending on the particular transaction. It is also important to note that these costs are in addition to the down payment that the buyer will need to make on the home.

What Are Seller-Paid Closing Costs?

In some cases, the seller may be expected to pay certain closing costs on behalf of the buyer. This is often seen in situations where the sale price of the home is low, or the market is slow.

Seller-paid closing costs can include:

- Agent Commissions

- Home warranty

- Loan origination fee

- Mortgage insurance premium

- Property taxes

- Survey fee

- Title insurance

- Transfer taxes

As with buyer-paid closing costs, there could be other fees that the seller is responsible for depending on the terms of the sale.

Should You Ask the Seller to Pay Your Closing Costs?

Whether or not you should ask the seller to pay your closing costs will depend on a number of factors, including:

- The current market conditions

- The sale price of the home

- Your personal financial situation

- The seller’s motivation for selling

If you’re buying in a buyers’ market, you may have more negotiating power and could be more likely to get the seller to cover your closing costs. On the other hand, if you’re purchasing in a seller’s market or the sale price of the home is already low, it may be less likely that the seller will be willing to contribute.

The Benefits of Seller-Paid Closing Costs

There are a few advantages to having the seller pay your closing costs, including:

- You can avoid coming up with extra cash at closing.

- It can make it easier to get approved for a loan.

- It may increase your chances of getting your offer accepted.

The Disadvantages of Seller-Paid Closing Costs

While there are some benefits to asking the seller to pay your closing costs, there are also a few potential disadvantages, including:

- It could reduce the amount of money you have for a down payment.

- It could lead to a higher interest rate on your mortgage.

- The seller could increase the sale price of the home to cover their own costs.

What Are Some Negotiating Tactics for Asking the Seller to Pay Your Closing Costs?

If you’re interested in asking the seller to cover your closing costs, there are a few negotiating tactics you can use, including:

- Offering a higher purchase price: One way to sweeten the deal for the seller is to offer a slightly higher purchase price for the home. This could offset some of their own costs and make them more likely to accept your offer.

- Asking for concession at closing: Another option is to ask the seller to provide a concession at closing. This is basically an agreement between the buyer and seller that stipulates that the seller will pay a certain amount of money towards the buyer’s closing costs.

- Making trade-offs: In some cases, you may be able to negotiate with the seller by making trade-offs. For example, you could agree to pay for certain repairs in exchange for the seller covering your closing costs.

Examples of Common Win-Win Closing Cost Negotiation Tactics

There are a few common negotiation tactics that can be beneficial for both the buyer and seller, including:

- Offering a higher sales price – In exchange for a higher sales price, the seller may agree to pay for closing costs simply because, at the end of the day, the seller breaks even.

- Waiving repairs – The buyer may be able to get the seller to agree to pay closing costs if they’re willing to waive their right to ask for repairs after a home inspection.

- Longer escrow – Giving the seller extra time to move out after closing may be enough to convince the seller to pay for closing costs.

- Paying for half of the closing costs – In some cases, it may be beneficial for both parties to split the cost of closing costs evenly. This can help the buyer avoid having to come up with extra cash at closing, and it can provide the seller with some extra money.

Seller-paid closing costs can be a great way to reduce the amount of money you need to bring to closing. However, it’s important to remember that there are potential disadvantages, so be sure to weigh your options carefully before making a decision.

Common Reasons Why a Seller May Refuse to Pay Closing Costs

1. When the Sales Price Is Already Negotiated

If the sales price of the home has already been negotiated, the seller may be reluctant to pay closing costs because it would essentially mean that they’re paying more for the home.

2. When the Seller Is Already Giving a Concession

In some cases, the seller may already be providing a concession, such as paying for repairs or offering a longer escrow period. Asking the seller to also pay for closing costs could be seen as too much of a request.

3. When the Buyer Is Already Getting a Good Deal

If the buyer is already getting a good deal on the purchase price of the home, the seller may feel like they shouldn’t have to pay for closing costs as well.

4. When the Seller Is Under Financial Strain

If the seller is already under a financial strain, they may not be able to afford to pay for closing costs. In this case, asking the seller to cover these costs could put them in a difficult position.

What If the Seller Isn’t Willing to Pay Your Closing Costs?

If the seller isn’t willing to pay your closing costs, there are a few options you can consider, including:

- Asking for a credit at closing: One option is to ask the seller for a credit at closing. This means that the seller agrees to contribute a certain amount of money towards your closing costs. This can be helpful if you’re short on cash but still want to avoid going over your budget.

- Paying for some of the costs yourself: Another option is to simply pay for some of the closing costs yourself. This can help keep your overall loan amount lower and may make it easier to get approved for a mortgage.

- Negotiating a higher sales price: If the seller is unwilling to pay closing costs, you could try negotiating a higher sales price for the home. This can help offset the cost of closing and may be worth considering if you’re already close to your budget.

Don’t Negotiate Alone – Work With an Experienced Real Estate Agent

If you’re stuck negotiating with a seller and not currently working with a real estate agent, now is the time to find one. An experienced agent can help you navigate the negotiation process and may be able to offer advice on how to get the seller to pay for closing costs.

When it comes to real estate negotiations, there is no one-size-fits-all solution. The best approach will vary depending on the situation. However, by understanding the common reasons why a seller may refuse to pay closing costs, you’ll be in a better position to negotiate a deal that works for both parties.

Don’t go it alone. Contact our team at Shelhamer Real Estate Group. As a top-performing Los Angeles real estate brokerage, we have the experience and knowledge to help you successfully navigate the real estate market. We can provide you with guidance and resources every step of the way, from finding the perfect home to negotiating the best possible price.

Find out the agents selling strategy and asking price

Positioning the property in the market to attract multiple offers is the goal. What’s the agent’s game plan for your home? Find out the offer price and learn the marketing strategy. Is there a specific amount of time for marketing? A specific number of open houses? The best Realtor will have a plan with a proven track record.

Conclusion

Work with a fulltime real estate agent or broker. When you find someone you like and want to hire, do your homework. If enough of the boxes are checked hire them!

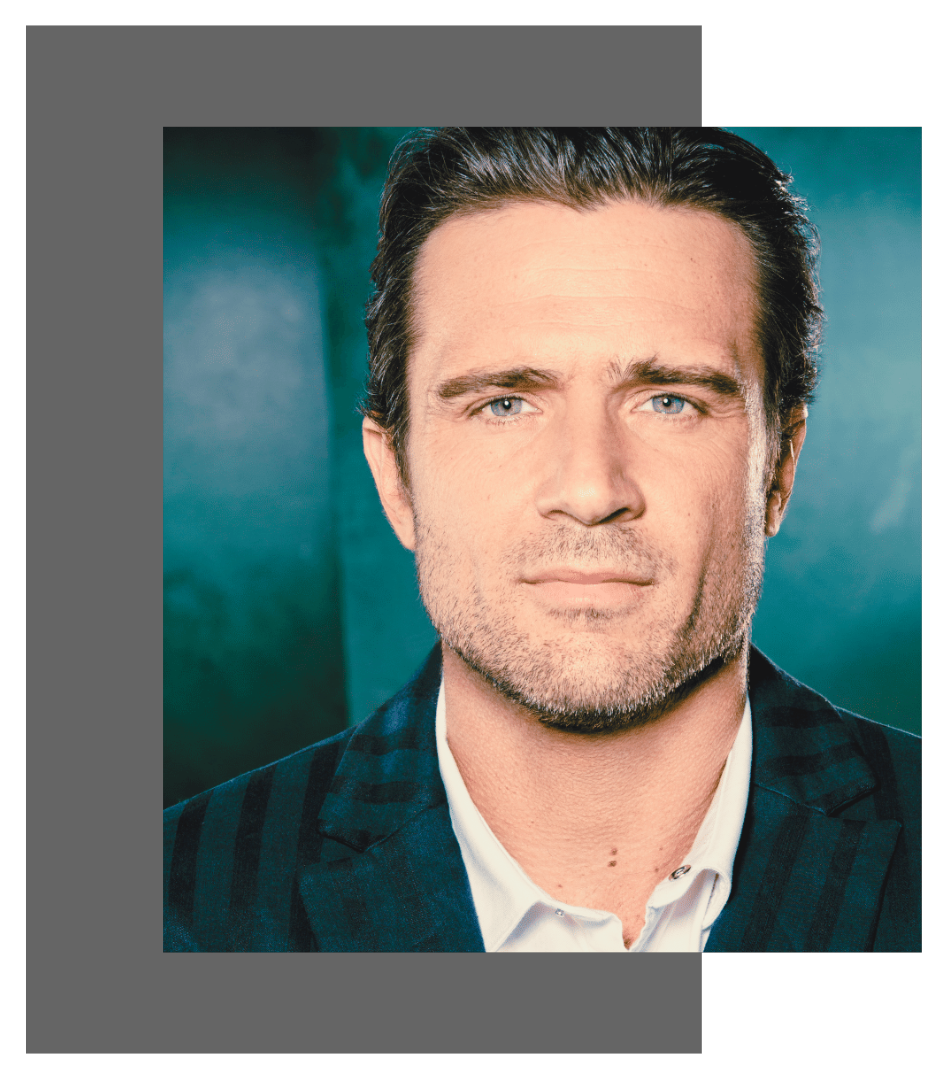

Glenn Shelhamer is a nationally recognized Real Estate leader who has been helping people move in and out of the Los Angeles area for many years. He is also the team lead of The Shelhamer Real Estate Group. When Glenn’s not selling real estate he can be found spending time with his beautiful wife and two terrific kids.