Los Angeles CA Real Estate Prediction | Forecast 2022

Watching the residential real estate market daily, I’m sure you’ll agree it has been a wild ride since February 2020. This article will discuss the southern California market boom triggered by the COVID-19 pandemic and where we go from here.

We need to remember how we got here to figure out where we’re going. In February 2020, our brokerage team canceled six escrows in one week. The media told us our country is on the brink of a lockdown due to an international pandemic. The stock market dipped, folks were quarantined in airports, and toilet paper sold out.

The switch flipped, and interest rates took a dip. The stock market recovered, and Los Angeles home sales boomed.

Our L.A. real estate brokerage worked overtime for nearly two years juggling buyers and listings, breaking sales records, and exceeding expectations. The year 2021 was much of the same and an absolute blur with an overwhelming amount of real estate sales business.

A stay-at-home order allowed us to reevaluate our living space and what we wanted. That, coupled with historically low-interest rates, was the perfect storm for the continued desire to be a new homeowner or decide to sell laughing yourself to the bank. How much did you sell your house for?

April 2022 statistics show that Los Angeles County housing market is a seller's market.

There’s a surprise! The good news – you survived COVID-19, and the bad news – housing inventory is low. Where did all of the for-sale homes go? What happened to everyone excited about selling?

Here’s the hard truth, Southern California home prices are still zipping and soaring, and a couple of plates are spinning.

On the one hand, the feds raised interest rates for the first time since 2018 in March 2022, which shocked the housing market. We knew rates were due to go up, but nobody expected so high so quickly. Then they did it again!

If that weren’t enough, rates would continue to go up several more times before the end of 2022. Forget about the 2.5% rates and be grateful we’re not at 7%.

We have the other hand to look at if that wasn’t a big enough bummer. Homeowners are staying in their current homes and not selling. Why? Because there’s a stigma surrounding proposition 19 is one reason.

Proposition 19 is a California property tax law that allows seniors and disabled homeowners to keep their current property tax rate when selling their homes and buying a new one. Another reason Los Angeles homeowners are not selling is because they are priced out of the market. It makes sense for property owners to sell if they move into a care facility, relocate out of state, or simply cashing out. Most of our older demographic is living on a fixed income.

Here's why it's an excellent time to sell:

Recording-breaking sales

Our real estate team has broken sales records in multiple zip codes in the Northeast Los Angeles market. Real Estate has appreciated by 20% within 22 months – we see record-high sales prices throughout the city. You could take advantage of this period by causing your property to sell for a higher price than it ever has before.

Leaving L.A.

Now, selling your home could represent the highest selling price within the next ten years, but what do you do next? Many folks are heading out of Los Angeles and California. The average monthly living expenses for a single person in the USA (outside of California) are $3,189, $38,266 per year. Cashing out of Los Angeles is a smart choice if you can let the city go.

Here's why it's an excellent time to buy:

Interest rates

Rates may still be on the rise for likely the next few months, and things will simmer down but give it time in the post-pandemic world of real estate. Get in now before rates do go up. If they go down, they might be around the fall or early winter of 2023, according to mortgage professional Joe Tishkoff with Finance of America Mortgage in Agoura Hills.

According to Joe, “you may likely have an option to refinance later with the prediction that rates will migrate back down by 1% to 1.5% in early 2023.”

With astonishingly low inventory and a lack of motivated sellers, if you’re considering buying a home, you need a savvy team of real estate professionals to help you navigate the brutal landscape in front of us and is today’s “new normal.”

My team has an abundance of buyer-centric techniques that will make your offer seen, and unlike most real estate brokerages, we like to work with buyers…they become happy sellers down the road!

Real Estate or Stock Market

So you got $100,000. Congratulations. That’s great.

Are you gonna invest in real estate or the stock market? What are you gonna do if it was me? I’d invest in real estate all day long. Do you have a primary residence? If you don’t, you should grab one. If you already have one, let’s get some units, let’s get some investment, property dollars coming in.

Let’s cash flow for you.

Invest in real estate, the dirt. We’re not making any more of, we can do several different things with improvements. You can do additions, you can renovate, you’re gonna build equity, you can leverage, you can buy more, right? The stock market. It’s a gamble. You don’t know the people and they’re out there somewhere. It’s like fairy dust, right? Do the right thing and invest in yourself. That’s what I would do.

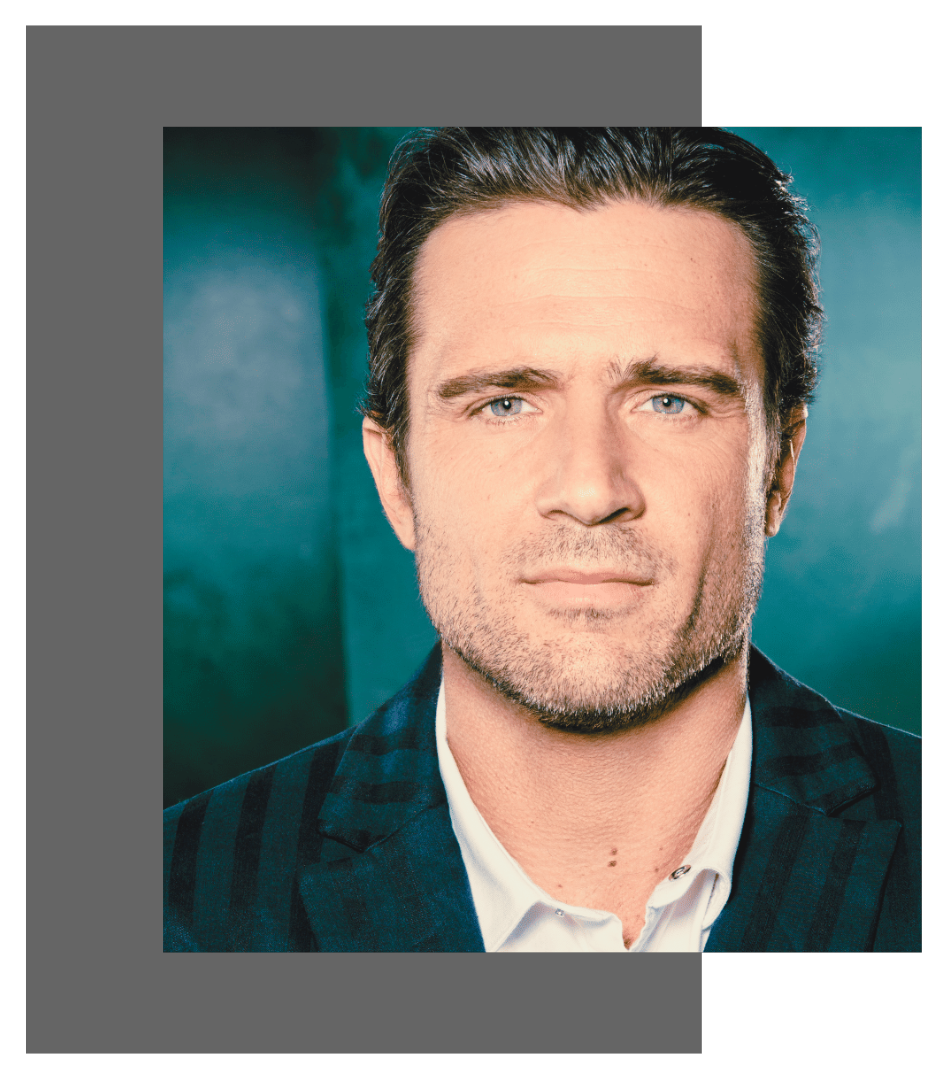

Glenn Shelhamer is a nationally recognized Real Estate leader who has been helping people move in and out of the Los Angeles area for many years. He is also the team lead of The Shelhamer Real Estate Group. When Glenn’s not selling real estate he can be found spending time with his beautiful wife and two terrific kids.