Hurry California's Spectacular Dream For All Program Is Here!

Hurry California’s Spectacular Dream For All Program Is Here! In this article, I break down the current California Dream For All Program, the down payment assistance for first-time home buyers, and the ins and outs of the CalHFA Dream For All Loan. If you want to pay yourself first and build wealth in real estate that’s my business. If you want to continue renting that’s yours. Reach out to me (David Clark) directly with further questions. Let’s get you introduced today to one of our preferred lenders this week. Let 2024 finally be the year you become a homeowner! Day one or one day?

CalHFA Dream For All Loan

For those embarking on the journey of purchasing their first home, the California Housing Finance Agency recognizes the apprehension that financial considerations can bring to this significant life step. Addressing these concerns they present a unique opportunity to turn the dream of homeownership into reality. In the previous round, when the California Housing Finance Agency introduced no-interest, no-monthly-payment loans to aid lower-income residents, the response was overwhelming, depleting the allocated funds in a short span. Building on this experience, the program has undergone enhancements to better cater to those in need.

Dream For All Program

This spring, an additional $225 million will be allocated to support aspiring homeowners. However, unlike the previous rush, the process has been refined. Qualified applicants will be chosen through a fair lottery system, departing from the initial first-come, first-served approach. The eligibility criteria have also been fine-tuned to ensure the program serves those facing the most significant housing challenges. Applicants are required not only to be non-homeowners but also to have parents who are non-homeowners, underscoring the commitment to assisting Californians in challenging housing market situations.

The California Dream for All Shared Appreciation Loans, designed to cover down payments and closing costs on a first home, offer a maximum of $150,000 or 20% of the home’s purchase price, whichever is smaller. What sets these loans apart is their lack of interest accrual. Instead, their value aligns with the appreciation of the home over time. Picture repaying the loan only upon refinancing, selling your home, or paying off the first mortgage – and doing so without the burden of interest. Better yet, if your home’s value increases, repayment includes a percentage of the appreciation matching the initial loan coverage. If the value remains unchanged, no additional amount is added to the loan.

Down Payment Assistance

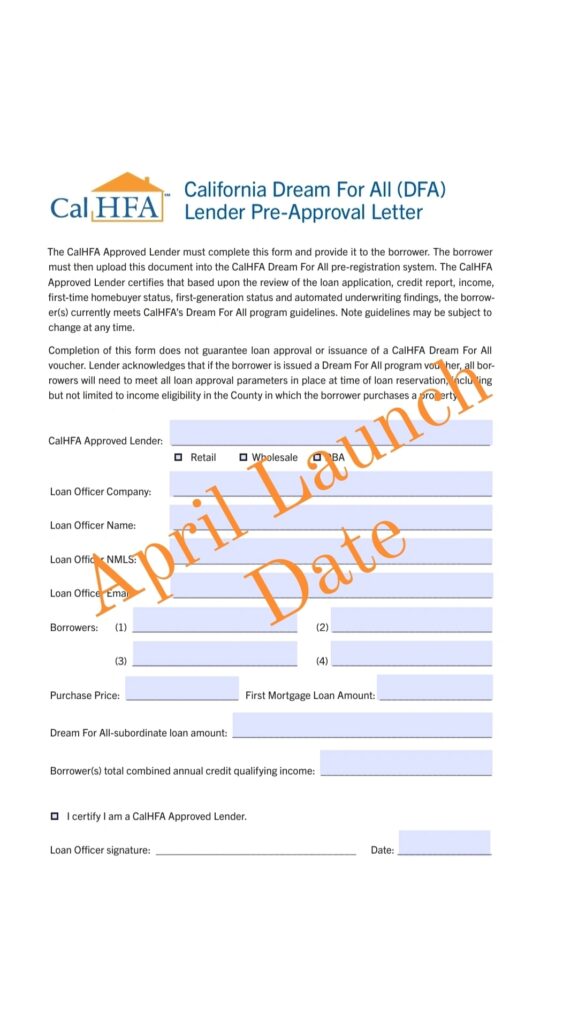

The aim is to make homeownership accessible and worry-free. While applications will be accepted online starting in April, prospective homeowners can already collaborate with participating lenders to prepare the necessary paperwork. Take a step towards the dream home without the fear of overwhelming financial obligations. The California Housing Finance Agency is dedicated to supporting individuals on their journey to homeownership.

Thank you for reading Hurry California’s Spectacular Dream For All Program Is Here! I hope that you have a clearer breakdown of the current California Dream For All Program, the down payment assistance for first-time home buyers, and the ins and outs of the CalHFA Dream For All Loan.

As a Los Angeles realtor and Angeleno, I have seen the ebbs and flows of several real estate markets. I continue to have my finger on the pulse of the emerging neighborhoods and have a focus on both the preservation of architecturally significant properties while being a steward of green architecture and new modern development to help ease our strain on the lack of housing inventory.

I am a Senior Real Estate Specialist (SRES®) holding certifications in Probate and Trust Sales and Accessory Dwelling Units. My marketing and negotiation skills, combined with community outreach have helped me build a solid reputation with my clients. I continue to empower my clients with this knowledge, helping them get closer to building wealth and financial independence.

Mls Disclaimer:

Based on information from the / Association of REALTORS® (alternatively, from the /MLS) as of [date the AOR/MLS data was obtained]. All data, including all measurements and calculations of area, is obtained from various sources and has not been, and will not be, verified by broker or MLS. All information should be independently reviewed and verified for accuracy. Properties may or may not be listed by the office/agent presenting the information