Home Buyer's Guide

Table of Contents

The Home Buying Process

A Brief, Step-by-Step Overview

If you’re like most of us, buying a home represents your single biggest investment – and debt. As such, the home buying process can be one of the most exciting – but sometimes stressful – experiences you ever go through. This may be true whether you’ve bought many homes or you’re buying your first – whether you’re in the market for a new primary residence, an investment property, or that perfect vacation getaway.

Moreover, never has the real estate market offered better opportunities, or been fraught with more risks, than now. There are many factors to consider and many decisions to make. That’s why, when buying, it’s crucial for you to have all the available resources necessary to make a well-informed decision, together with the time required to make complete use of them. That’s also why you should enlist the help of a trusted realtor who’ll be able to provide you with expert consultation at each step of the buying process.

Generally, finding and purchasing a home includes the following steps, some of which are examined in more detail throughout this article.

Step 1: Define Your Goals, Research Your Options, Dive-In With Confidence

Given that buying a home is such a big step, it’s all the more important for you to educate and prepare yourself as much as possible in advance. This means clearly determining why you’re buying and what kind of home you’re looking for. And, because buying and financing a home are so closely related, it also means examining your current financial situation and projecting how much you can afford.

Once you’ve answered these questions – even tentatively – you’ll be in a better position to research your housing and mortgaging options, as well as create an action plan and timelines for moving forward. You may want to do this yourself, but you may also benefit by consulting an experienced realtor right from the start.

Step 2: Contact a Realtor

Buying real estate is a complex matter at the best of times – given that there are so many factors to consider and no two home transactions are alike. However, with all the unique opportunities and potential pitfalls of the current market, it’s even more important for you to contact a realtor once you’ve definitely decided to buy.

In choosing a realtor to guide you through the property search, financing, negotiation and transaction processes, you should consider their local market knowledge, experience, and track record.

Step 3: Get Pre-Approved for a Loan

Generally, it is recommended that you get pre-approved for a loan before you start viewing homes with the serious intention of buying. The pre-approval process involves meeting with a lender (via email, telephone, text message, or Zoom) and authorizing them to examine your current financial situation and credit history. On the basis of this examination, the lender or mortgage advisor will provide you with a document that details how much you can borrow to buy a home.

You may want to consider looking online to see what different lenders offer such as PRMG or contacting your locak bank or credit union.

The benefits of pre-approval include:

- Lenders can tell you whether you qualify for any special programs that will enable you to afford a better home (particularly if you’re a first-time home buyer).

- As an approved and motivated buyer, you’ll be taken seriously and be able to act quickly.

- You’ll be ready to start house-hunting with your realtor, because you’ll know your buying power and be able to plan accordingly.

Real estate financing is available from many sources, and an experienced realtor will be able to suggest lenders with a history of offering excellent mortgage products and services.

Step 4: Shop Homes and Select 'The One'

Simply put, the key to the home search process is knowing what you’re looking for. Among other things, that means distinguishing between “must-haves” and “like-to-haves.” To help you target your search and define your home preference priorities, we’ve created a Home Search Worksheet available free to download.

That said, here are a few recent facts about the search process that might put your experience in perspective:

- Almost 90% of buyers use the internet to search for homes.

- The typical buyer searches for 5 weeks and views 12 homes.

- 88% of buyers view real estate agents as very useful in the search process.

There are many benefits to starting the search process at a real estate website like ours at The Shelhamer Group. You can view many homes and their details, take video tours, and access neighborhood info including schools, parks, and air quality. Plus, take advantage of the useful Resources Page. We at The Shelhamer Group have assembled useful links to websites and literature that will help you better understand your rights and obligations in these complex real estate transactions.

It’s important to view homes in person. While their property details may seem similar online, homes can actually be very different in terms of layout, design, workmanship, and other aspects. In addition, you should ideally view homes with the help of an experience and eagle-eyed realtor who’ll notice things you might miss, provide expert analysis, and act as an impartial sounding board. This process is all about you and what’s best for you.

A Home Buyer's Glossary

When buying real estate, it’s important to understand some of the key concepts and terms. Throughout the purchase process, your realtor will be available to explain any unfamiliar terms you encounter. That said, here is a short list of terms you’ll want to know.

Abstract of Title – A complete historical summary of the public records relating to the legal ownership of a particular property from the time of the first transfer to the present.

Adjustable Rate Mortgage (ARM) – Also known as a variable-rate loan, an ARM is one in which the interest rate changes over time, relative to an index like the Treasury Index.

Agreement of Sale – Also known as the purchase contract, purchase agreement, or sales agreement according to location or jurisdiction. A contract in which a seller and buyer agree to transact under certain terms spelled out in writing and signed by both parties.

Amortization – The process of reducing the principal debt through a schedule of fixed payments at regular intervals of time, with an interest rate specified in loan document terms spelled out in writing and signed by both parties.

Appraisal – A professional appraiser’s estimate of the market value of a property based on local market data and the recent sale prices of similar properties.

Assessed Value – The value placed on a home by municipal assessors for the purposes of determining property taxes.

Closing – The final steps in the transfer of property ownership. On the Closing Date, as specified by the sales agreement, the buyer inspects and signs all the documents relating to the transaction and the final disbursements are paid. Also referred to as the Settlement statement.

Closing Costs – The costs to complete a real estate transaction in addition to the price of the home, may include points, taxes, title insurance, appraisal fees and legal fees.

Contingency – A clause in the purchase contract that describes certain conditions that must be met and agreed upon by both buyer and seller before the contract is binding.

Counter-Offer – An offer, made in response to a previous offer, that rejects all or part of it while enabling negotiations to continue toward a mutually-agreeable sales contract.

Conventional Mortgage – One that is not insured or guaranteed by the federal government.

Debt-to-Income Ratio – A ratio that measures total debt burden. It is calculated by dividing gross monthly debt repayments, including mortgages, by gross monthly income.

Down Payment – The money paid by the buyer to the lender at the time of the closing. The amount is the difference between the sales price and mortgage loan. Requirements vary by loan type. Smaller down payments, less than 20%, usually requires mortgage insurance.

Earnest Money – A deposit given by the buyer to bind a purchase offer and which is held in escrow. If the property sale is closed, the deposit is applied to the purchase price. If the buyer does not fulfill all contract obligations, the deposit may be forfeited.

Equity – The value of the property, less the loan balance and any outstanding liens or other debts against the property.

Easements – Legal right of access to use a property by individuals or groups for specific purposes. Easements may affect property values and are sometimes part of the deed.

Escrow – Funds held by a neutral third-party (the escrow agent) until certain conditions are met and the funds can be paid out. Escrow accounts are also used by loan servicers to pay property taxes and homeowner’s insurance.

Fixed-Rate Mortgage – A type of mortgage in which the interest rate does not change during the entire term of the loan.

Home Inspection – Professional inspection of a home, usually paid for by the buyer, to evaluate the quality and safety of its plumbing, heating, wiring, appliances, roof, foundation, etc.

Homeowner’s Insurance – A policy that protects you and the lender from fire or flood, a liability such as visitor injury, or damage to your personal property.

Lien – A claim or charge on property for payment of a debt. With a mortgage, the lender has the right to take the title to your property if you don’t make the mortgage payments.

Market Value – The amount a willing buyer would pay a willing seller for a home. An appraised value is an estimate of the current fair market value.

Mortgage Insurance – Purchased by the buyer to protect the lender in the event of default (typically for loans with less than 20% down). Available through a government agency like the Federal Housing Administration (FHA), or through Private Mortgage Insurers (PMI).

Possession Date – The date, as specified by the sales agreement, that the buyer can move into the property. Generally, it occurs as soon as title is recorded into the buyers name.

Pre-Approval Letter – A letter from a mortgage lender indicating that a buyer qualifies for a mortgage of a specific amount. It also shows the home seller that you’re a serious buyer.

Principal – The amount of money borrowed from a lender to buy a home or the amount of the of the loan that has not yet been repaid. Does not include the interest paid to borrow.

Purchase Offer – A detailed written document which makes an offer to purchase a property and which may be amended several times in the process of negotiations. When signed by all parties involved in the sale, the purchase offer becomes a legally binding sales agreement.

Title – The right to, and the ownership of, property. A title or deed is sometimes used as proof of ownership of land. Clear title refers to a title that has no legal defects.

Title Insurance – Insurance policy that guarantees the accuracy of the title search and protects lenders and homeowners against legal problems with the title.

Truth-in-Lending Act (TILA) – Federal law that requires disclosure of the truth-in-lending statement for consumer loans. The statement includes a summary of the total cost of credit.

Title Search – A historical review of all legal documents relating to ownership of a property to determine if there has been any flaws in prior transfers of ownership or if there are any claims or encumbrances on the title of the property.

To Buy or Not to Buy

Considerations for First-Time Home Buyers in this Market

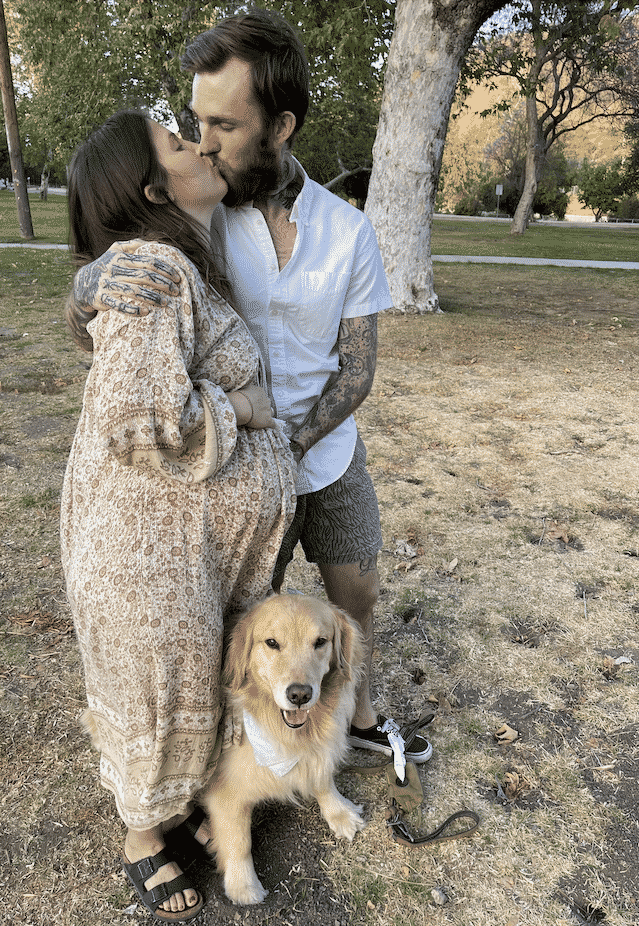

Buying your first home is a major step – especially in Los Angeles. There’s a lot you need to know to make the right decisions – and also to avoid making the wrong ones. And, that’s particularly true in this current market and the wake of COVID-19.

The good news is that if you know what you’re doing – or if you’re working with a highly-experienced and skilled realtor who does – this market offers fantastic opportunities to get a great home at a great price.

Owning vs. Renting

Without question, owning a home comes with responsibilities and risks that you don’t have to worry about when you rent, such as a mortgage, taxes, homeowner’s insurance, maintenance, and repairs, to name a few. However, financial advisors – not to mention homeowners themselves – say there are far more advantages to owning:

- Historically, it has trended that over time, you’ll lose money by renting instead of owning your own home. Why not build up equity in a home instead of paying your landlord’s mortgage?

- Although there are periodic market drops, historically, owning a home has been a prime financial investment.

- You can take advantage of many ongoing tax benefits like deducting the interest on your mortgage and property taxes from your income tax.

- Owning a home isn’t just a good investment in financial terms. It’s also an investment to a higher quality of life – particularly if you have a family or if you’re planning one.

- There’s a special kind of pride in the ownership and upkeep of a home that you won’t get with renting.

At the end of the day, it just feels good to own your own home. You can decorate it any way you like renovate or build additions, personalize your landscaping, you name it!

Do You Qualify to Own?

There’s only one way to find out: go to your bank or another lending institution and allow them to perform a credit check and analyze your financial situation. You might be surprised to know that there are many renters who are financially qualified to own their own homes, but don’t realize it. Are you in this category?

It will be a shame if you wanted to own your own home but didn’t know you could. Also, keep in mind you may be eligible for loans insured by the Veterans Administration (VA) or Federal Housing Administration (FHA).

Is it a Good Time to Buy?

Generally speaking, if you’re financially qualified, your timing couldn’t be better. In fact, few markets have ever offered the kinds of opportunities that currently exist for first-time homebuyers in Los Angeles because:

- Mortgage rates are historically low. You might be able to lock in a very low rate on a 30-year fixed mortgage.

- There is still inventory throughout Los Angeles County and beyond.

- There are many foreclosed homes and distress sale listings available at greatly reduced prices on the east side of Los Angeles and other LA neighborhoods.

- There are many builder liquidations popping up – i.e. new homes available at greatly reduced prices.

So the bottom line is that if you’re currently renting, you really want to own a home. This is a fantastic time to buy. And, again, you may qualify to buy and not know it so talk to a knowledgeable experienced realtor about your options. Your realtor will not only be able to guide you towards getting all the financial support you qualify for but you’ll also get the scoop on the many and various great real estate opportunities currently available.

Not only that, but in case you didn’t know, all the work that a realtor does to help you find, finance, and purchase a home won’t cost you a penny. It’s all paid for by the seller or listing agent commission!

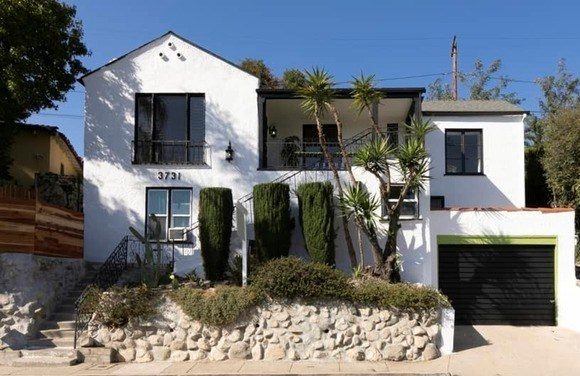

Echo Park is a densely populated neighborhood in the central region of Los Angeles and is typically known as part of the Eastside of LA. Today Echo Park is known for its thrift stores, The Dodgers, dive bars, and vinyl shops. Echo Park has come a long way from being a gateway to immigrants of the city at the turn of the century; to becoming the foundation of the culturally thriving community in Echo Park. Oh, and let us not forget the beautiful lake, from which the namesake is derived. That used to be a dump (literally) how quickly things are changing in Echo Park, CA.

The Loan Process

Financing Your Home Purchase

Unless you’re one of the rare few who are able to pay cash for your home, central to buying is finding the right lender and mortgage product. There are many different kinds of lending institutions offering a wide range of loans and special programs.

In fact, you should diligently research your options and shop around for a mortgage with as much care as you take when looking for a home. Your realtor should have a preferred direct lender or a team of mortgage advisors.

Educate Yourself About Your Options

There are a myriad of loan types and programs available through 1000s of banks, finance companies, credit unions and other assorted lenders. Not surprisingly, there are just as many sources of information about mortgages, websites like ours here at The Shelhamer Group, books, news articles, seminars, mortgage brokers, lenders, and knowledgeable realtors can all help you make your way through the labyrinth of financing possibilities, so make use of them! And, be sure to get a few opinions. In short, do your homework before you put your name on the line. Because what you don’t know could hurt you.

The Shelhamer Group recommends Joe Tishkoff’s team at Finance of America. Joe is a 34-year veteran of real estate finance. He has the kind of experience that counts in the fast-paced world of Los Angeles real estate. He has become very much in tune with local Los Angeles conditions. Intelligence and a strong work ethic are essential elements of his success in helping our buyers become happy homeowners.

#1 Sincerely Examine Your Financial Situation

Together with educating yourself about your loan options, you should be asking yourself how much mortgage and downpayment you can comfortably afford. Make yourself accountable. What might you be giving up – not just every month, but also perhaps 20 years down the road by extending yourself further?

Maybe taking on a larger mortgage will pay off greatly as an investment. Maybe it won’t. Be sure to weigh the risks and opportunity costs. Along these lines, here at shelhamergroup.com, we want you to be prepared for the next step. Try the loan calculator below to help you determine what your regular payments will be based on your projected down payment, the loan principal, the interest rate, and the mortgage term.

One other point to note is that some lenders will qualify you for the maximum they’re willing to lend. However, this may not be a good thing. In fact, it may be more than you can truly afford, given all your other responsibilities.

A skilled and trustworthy lender will be sure to factor all related taxes, insurance, improvements, homeowner fees, and all other potential costs into the equation for you.

The bottom line is you should know your monthly expenses, as well as project your financial commitments during the life of the mortgage. This will provide a realistic figure of what you can afford.

In shopping for a loan you should consider two main sources: direct lenders and mortgage brokers. Direct lenders have the money and make the decisions that have a limited number of in-house products to offer. Brokers are intermediaries who charge a fee but can provide you with loan options from many sources and can often save you money overall.

#2 Your Basic Mortgage Options

Generally, there are two ways you can go: a fixed-rate mortgage with an interest rate that remains the same for the life of the loan or an adjustable-rate mortgage (ARM) with a rate that adjusts up or down depending on economic trends.

The advantages of a fixed-rate mortgage – particularly if you lock in at a lower rate – are that they protect you against the risk of rising interest rates and their stability can also make it easier for you to plan and budget your short and long-term expenses. Their downside is that generally is that they generally have higher rates than ARMs at any given time. And, by locking in at that rate, you run the risk of being trapped at a relatively high rate of interest if interest rates fall.

Another main consideration with a fixed-rate mortgage is the term. Shorter-term mortgages like a 15-year have lower rates than a 30-year. In other words, the shorter term, the lower rate. The shorter-term and lower rate means that you’ll pay less interest over the life of the loan, although your monthly payments will generally be higher.

On the other hand, an adjustable-rate mortgage (ARM) is commonly based on the US Treasury index for a one-year treasury bill, although it may also be geared to other indexes. Generally, lenders add 2% to 4% to the index rate to get their ARM rate. Initially, the rate is lower than the fixed-rate by a quarter-point to two points or possibly even more. This rate will periodically adjust within set limits – or caps – that are specified by the terms of the loan.

Finally, it must be reiterated that the loan you ultimately qualify for will depend on your credit status. The best rates and terms are only available to those with solid credit. So, if possible, pay off your credit cards and make all other bill payments in full and on time.

#3 Apply for a Mortgage

It’s advisable to complete this process before open house shopping. Window shopping is fine. But if you want to be taken seriously by sellers and realtors, you should have your pre-approval letter in hand. When you apply with the chosen lender, in order to complete the application you’ll need to provide several documents that show details about your household income, job tenure and stability, assets, existing debt, and regular expenses. This may take the form of pay stubs, bank and investment statements, tax returns, and other documentation. The lender will also check your credit status.

During the application process, you’ll discuss the different loan options and programs you qualify for, as well as finalize the amount of your required downpayment. If you place less than 20% down, the lender may require the mortgage to be guaranteed by a third party, such as the Veterans Administration (VA), Federal Housing Administration (FHA), or private mortgage insurance (PMI).

Because there are so many considerations and so much at stake, make sure you bring all your questions to the table. This includes asking the lender to explain all terms of the mortgage. You may find that having a trusted and knowledgeable realtor by your side to explain every aspect of the mortgage contract will increase your peace of mind. Lastly, if you qualify for the loan you’re seeking, the lender will often have the home you’re buying professionally appraised to ensure it is worth the purchase price.

Successfully Negotiating the Deal

Strike a Balance - Motivated, But Not Too Eager

Negotiating the transaction is usually the most complex aspect of buying a home at the same time. It’s one that can involve the most creativity.

That’s why it’s important for you to have an experienced and savvy realtor in your camp who successfully works through many different transaction scenarios. That said, what follows are a few strategies for negotiating a good deal in a market like this one, all of which involve:

- Presenting yourself as a serious buyer while at the same time keeping your emotions in check.

- Trying to understand and respect the priorities of the seller.

- Being creative, and where necessary, willing to compromise to get the deal done.

For you – as a buyer – it all starts before you even make an offer. The first time you see a home you think might be the one, it’s important that you not give yourself away to the listing agent by getting too excited about your find. If anything, ask a few questions, maybe take a few notes, and let your realtor do most of the talking.

Ideally, you’re trying to strike a balance by appearing to be a qualified and motivated buyer, while not appearing to be too eager. You’ll demonstrate that you’re a serious buyer – the kind sellers look for – at the time you make the offer, particularly if you:

- Have already sold your present home – if you have one – or, you make it clear that you’re not dependent upon selling in order to buy.

- Submit a complete offer package.

- Make an offer that still gives you room to negotiate once in escrow.

Not only will this approach show that you’re qualified and motivated, but it will also place you in a stronger negotiating position overall. The sellers won’t want to lose you and will be more inclined to reduce their price a little and/or make some concessions with respect to terms once you’re in escrow based on the true condition of the property.

Understand and Respect the Seller's Priorities

Through negotiations, if you can find out more about the seller’s situation and priorities, you’ll not only improve your position, but you’ll also be able to resolve any obstacles more creatively and sensitively.

For instance, if a seller is adamant about the sale price, they might be more flexible about taking care of a few repairs or part of the transaction costs. Or, if they need a certain closing date, you might be able to get them to concede some other terms.

There is no one size fits all approach to negotiating, particularly in the current market. In general, the more you know about the seller’s priorities, the better position you’ll be in to negotiate favorable terms.

Is it Really The One? If So, Make it So

Even in a market like this one, if you’re really interested in buying the home you’re negotiating over – if it really is the one – you should be willing to make some compromises to make the deal happen. If that’s not the case, then you should listen to your heart and consider looking for another home. It just might be out there waiting for you.

That said, here are a few basic principles of successful negotiation strategies to consider if you’re committed to completing your purchase:

- Remember your priorities and respect the seller’s priorities – But don’t let small things get in the way of your better judgment.

- If necessary, defer until later. If small issues do get in the way in the midst of big ones, focus on and consolidate your agreement on the big issues and come back to the small ones later.

- At the end of the day, if there are disagreements about relatively small expenses, split the difference, and smile Life is too short.

The reality is that most negotiations just proceed without much problem. In the event that there are difficulties, but you’re committed to buying the home…

Look Beyond the Price

While a home’s sale price is generally the focus of negotiations, often sellers will have needs – such as the terms of purchase – that can significantly influence the final deal. Additionally, it is in relation to the terms which can present represent 1000s of dollars in value.

In some situations, The Shelhamer Group has successfully negotiated with sellers paying our buyer’s closing fees. This could include lender points fees, escrows, and even contractors through escrow out of the seller’s net proceeds. Ask us how.

Here are some elements in the purchase agreement that you might put on the table for discussion:

- Release the EMD (earnest money deposit) early to the sellers.

- Closing and possession dates.

- Inclusion of furniture, fixtures, etc. not considered to be real property or incentive to sell.

- Payment for repairs required by your lender.

- Payment of taxes, utilities, and rents.

- Payment of title search and insurance.

- Payment of survey, transfer taxes, and recording fees.

- Payment of general and termite inspections.

- Payment of attorneys fees, if applicable.

Along these lines, the key is to get all the terms of purchase in writing within the agreement. These terms should then be carefully reviewed and clearly understood by both you and the seller so that you’re on the same page and negotiations move forward.

Expect Great Service from The Shelhamer Group

Many realtors are buyer specialists who focus on helping people successfully find and buy the homes they’ve

always wanted. One benefit of using their services is that they hear about listings right when they come to the market.

In fact, sometimes even before they’re on the market. And, that’s just the first step. When they work for you, they will:

- Educate you about Buyer Agency, outlining their professional responsibilities to you including complete disclosure, loyalty, confidentiality, obedience, and accountability.

- Help you explore your financing options and if required, refer you to some excellent mortgage professionals so you can make the best possible mortgage decision.

- Save you time by regularly searching the market for affordable homes that meet your criteria.

- Email your specific home requirements to top producing agents in the area so they know they have a qualified purchaser.

- View homes with you and provide comparative analysis. They can also refer you to expert home inspectors that will provide more in-depth analysis and advice about the true property condition.

- Provide consultation in relation to your written offer to purchase a home, with all terms approved by you.

- Negotiate the best possible price and terms for you and take care of all the documentation details.

In short, we’ll provide you with comprehensive high-quality buyer service. So when you decide to buy a home – or if you hear that any of your family and friends are looking to buy – be sure to take advantage of the knowledge, experience, and professionalism of a realtor at The Shelhamer Group.

THE SHELHAMER GROUP | DRE: 01950995

Glenn Shelhamer is a licensed real estate broker DRE: 01950995 in the state of California and abides by equal housing opportunity laws. All material presented herein is intended for informational purposes only. Information is compiled from sources deemed reliable but subject to errors, omissions, changes in price, condition, sale, or withdrawal without notice. To reach The Shelhamer Real Estate Group’s office manage please call (310) 913-9477.

© 2023 Shelhamer Group. All rights reserved.